Navigating Complex Accounts With Bookkeeping 7033906898

Navigating complex accounts through bookkeeping demands a thorough understanding of established principles and practices. Accuracy in financial reporting is crucial for businesses managing diverse transaction types. By leveraging technology, organizations can streamline their processes and minimize errors. However, the challenge lies in effectively managing multiple revenue streams while maintaining clear records. This balance is essential for fostering stakeholder trust and ensuring long-term financial health. What strategies can businesses implement to achieve this?

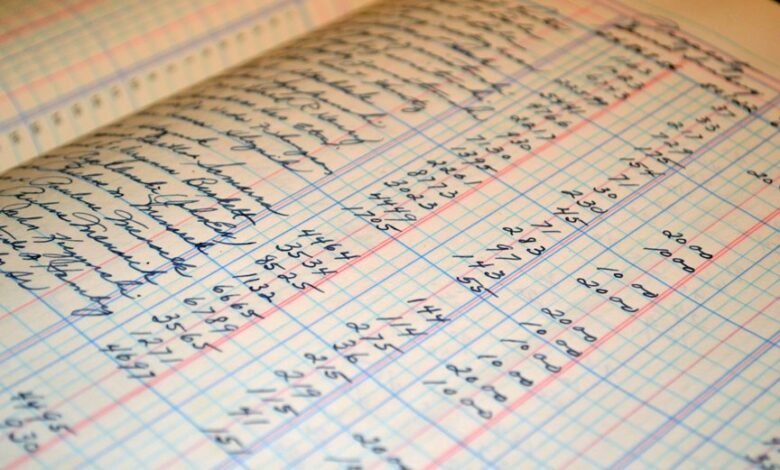

Understanding the Basics of Bookkeeping

Bookkeeping serves as the backbone of financial management for businesses, providing essential records that inform decision-making processes.

Understanding the basics involves familiarizing oneself with various transaction types, such as sales, purchases, and receipts.

Adhering to fundamental bookkeeping principles ensures accuracy and consistency, allowing businesses to maintain clear financial records.

This foundational knowledge empowers stakeholders in their pursuit of financial independence and strategic growth.

The Importance of Accurate Financial Reporting

Accurate financial reporting is critical for businesses, as it not only reflects the true financial health of an organization but also influences strategic decision-making.

Maintaining financial integrity hinges on reporting accuracy, which fosters trust among stakeholders.

In a landscape where transparency is paramount, organizations that prioritize precise financial reporting can navigate complexities effectively, ensuring sustainable growth and informed choices that align with their long-term objectives.

Strategies for Managing Multiple Revenue Streams

Diversification of revenue streams is a vital strategy for organizations seeking stability and growth in an increasingly competitive market.

Effective management requires meticulous expense tracking to ensure profitability across various channels. By identifying key performance indicators and regularly analyzing revenue diversification efforts, organizations can adapt to market shifts, optimize resource allocation, and ultimately enhance financial resilience while maximizing opportunities for sustainable income growth.

Streamlining Your Financial Processes With Technology

Many organizations are increasingly recognizing the profound impact that technology can have on streamlining financial processes.

Automated invoicing systems enhance efficiency by minimizing human error and expediting payment cycles. Additionally, the use of digital receipts simplifies record-keeping, ensuring accurate financial tracking.

Conclusion

In conclusion, effective bookkeeping is essential for maintaining accurate financial records and ensuring informed decision-making within a business. Notably, a study indicates that 82% of small businesses fail due to cash flow mismanagement, underscoring the critical need for robust financial practices. By leveraging technology and adhering to established principles, organizations can navigate complex accounts more efficiently, ultimately fostering trust among stakeholders and enhancing overall financial health.